Silent Confirmation Letter Of Credit

Under normal conditions the confirming bank could add its confirmation to a letter of credit upon the issuing bank s authorization or request.

Silent confirmation letter of credit. In letters of credit in addition to the commitment of the issuing bank the advising bank can by silent confirmation enter into its own independent commitment to pay or accept. The essential terms of the agreement were that. Due to court injunction insolvency exchange controls.

Banks in almost all trading. A silent letter of confirmation is similar to a formal letter of credit. The court in greenhill international pty ltd v commonwealth bank of australia confirmed that silent confirmations of letters of credit fall outside the uniform customs and practice for documentary credits 600 ucp 600 and are governed purely by the express and implied terms agreed to by the paying bank and the beneficiary.

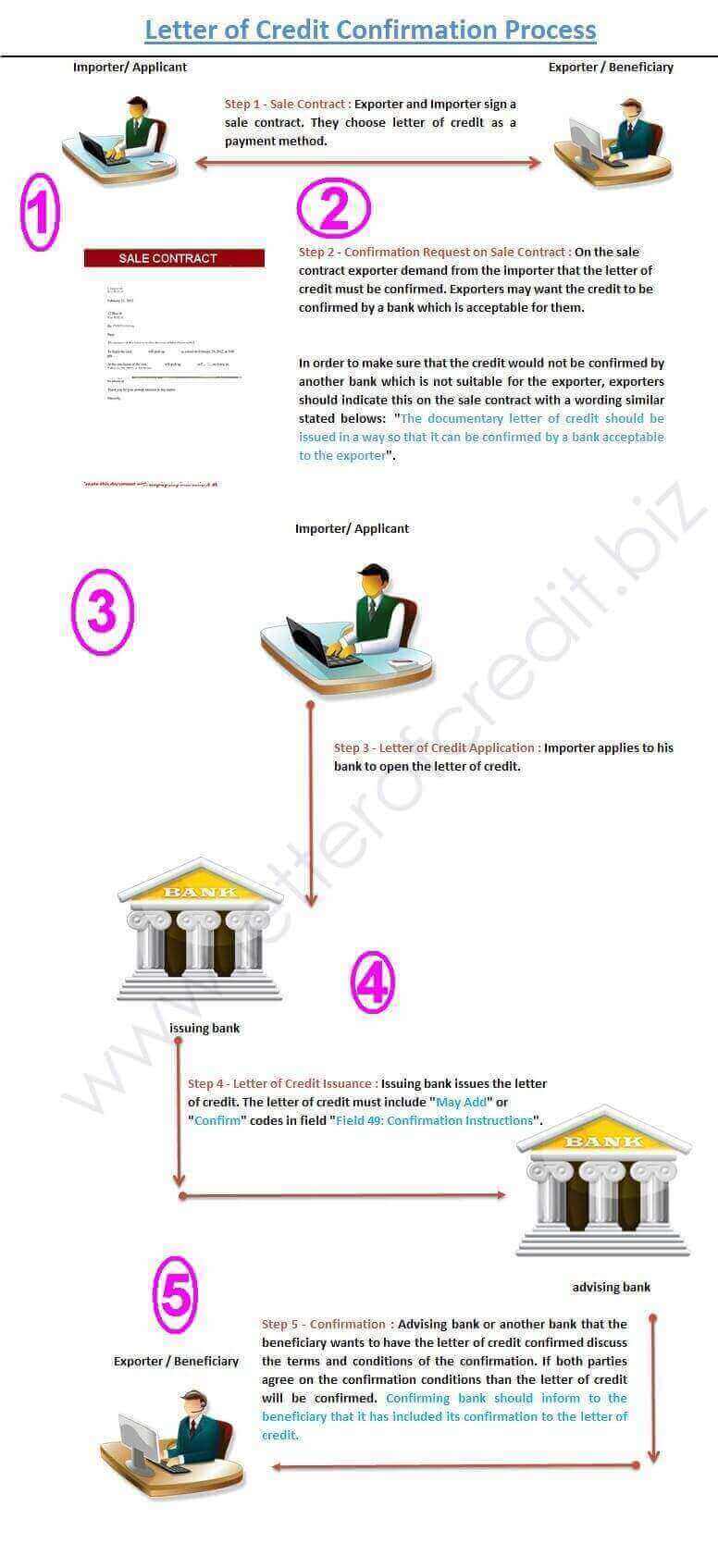

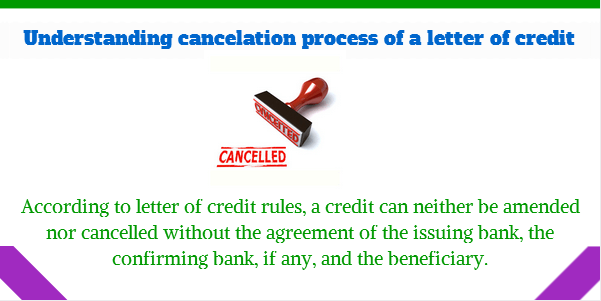

A silent confirmation is a confirmation issued to the beneficiary of a letter of credit by which the silent confirmation bank undertakes to pay the beneficiary thereby the beneficiary gains assurance of payment if for some reason the issuing bank refuses or cannot pay under the letter of credit e g. Rather than simply notifying the beneficiary that it agreed to negotiate the credit the cba entered into an agreement called a silent confirmation. During the issuance phase of a letter of credit the issuing bank should authorize or request the potential confirming bank to add its confirmation to the letter of credit.

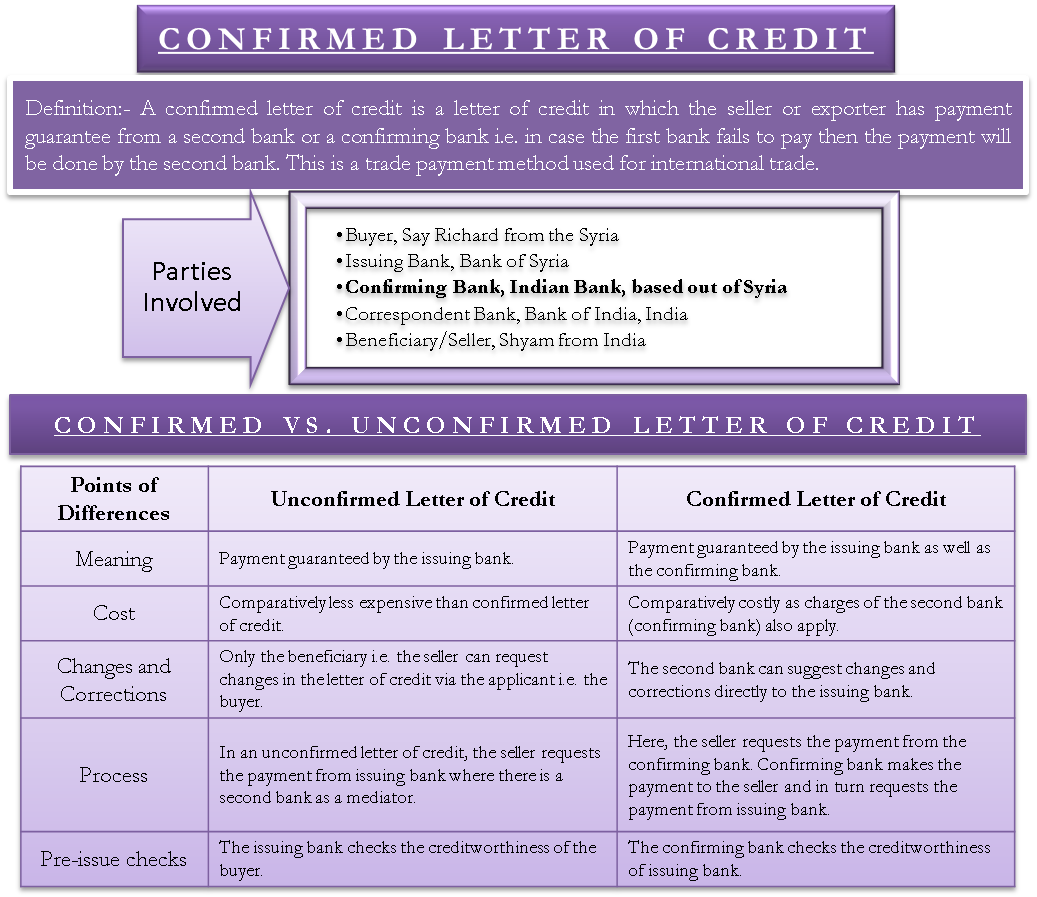

Only irrevocable letters of credit can be confirmed. If the confirming bank adds its confirmation to the credit without any request from the issuing bank then this procedure will be called as a silent confirmation or unauthorized confirmation. It also has the protection of a foreign bank backing up a domestic bank but the domestic bank has the opportunity to negotiate terms and prices with the seller.

The credit appears to have been a deferred payment credit payment due 180 days after a complying presentation of documents. Letter of credit l c confirmation provides a guarantee of payment to the exporter provided that all terms and conditions of an l c issued by another bank are complied with. It takes a form of open confirmation or silent confirmation depending on whether or not the confirmation is disclosed to all relative parties.

What does silent confirmation mean.